Kamis, 03 Oktober 2013

Rabu, 11 September 2013

History and comparative advantages of Takaful

Initial History of Sharia Insurance

All we know that islamic economic has been an alternative sistem to financial industry. Islam values was offers concept in economical activities and business conduct (namely Muamalah) with islamic ethic and moral bases. The islamic economic has so long historical experiences in practices. Now all we can see the emerging sharia financial industry at some global financial industry centers.

In the mid-late 20th century has emerged a new perspective on the world financial industry that derived from intellectual property of the Islamic world. Islam is the only religion that has rules in all aspects of moslems life. Sharia financial System has been more 30 years offering alternative products in global financial industry, Starting from Islamic Banking and has been growing very rapidly in London, one of European financial industry centers. Then followed the development of Sharia insurance or Islamic Insurance namely Takaful Insurance founded in 1980s.

Takaful Insurance (التكافل) is Islamic insurance concept which is grounded in Islamic banking, observing the rules and regulations of Islamic law. This concept has been practised in various forms for over 1400 years.[1] Muslim jurists acknowledge that the basis of shared responsibility in system of aquila as practised between Muslims of Mecca and Medina laid the foundation of mutual insurance.

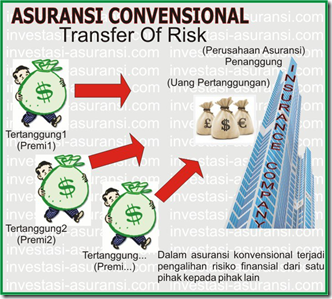

Comparison of Sharia Insurance and Conventional Insurance

There are significant differences of operation in both systems caused by differences in concepts, values and philosophy. Conventional insurance emerged as a pragmatic need to create business opportunities. Sharia

In conventional insurance risk transfer occurs between a group of the insured (Tertanggung) to the insurer

In conventional insurance risk transfer occurs between a group of the insured (Tertanggung) to the insurer

In Sharia insurance risk-sharing occurs among participants (Peserta) and collected donations mandated to the Takaful insurance as operator.

Sharia Insurance Versus Conventional Insurance

Case in Indonesia.SHARIA INSURANCE

- The operating system based on the Islamic Sharia law and the positive law.

- Having a Sharia Supervisory Board.

- Basic engagement is Akad ta'awun (helping each other); Sharing of Risk.

- The collected funds from all customers wholly is owned by the participants.

- Payment of claims from the collected funds of the account (all) customers.

- Investment gains are divided between the Company and the Customers.

- The loading cost not all be charged to participants, also comes from funds of shareholders. Loading cost of the participants were 20-30% of first premium. Thus the cash value established in the first year.

CONVENTIONAL INSURANCE

- The Operating system based on the general economic law

- Without Sharia Supervisory Board

- Basic engagement is Marketplace Agreement (Tabaduli); Transfer of Risk

- Premiums collected wholly is owned by insurance company

- Payment of claims come from company accounts

- Profit company wholly is owned by insurance company

- Loading cost is big enough, especially designed for company income and commission fee for insurance marketer. Loading cost absorb the premium of first year up to fifth. Therefore, cash value of the 5 years first is small value even at 2 years first does not exist.

Danke für besuch - Thank you for your visits

22.41

22.41

yusufzul

yusufzul